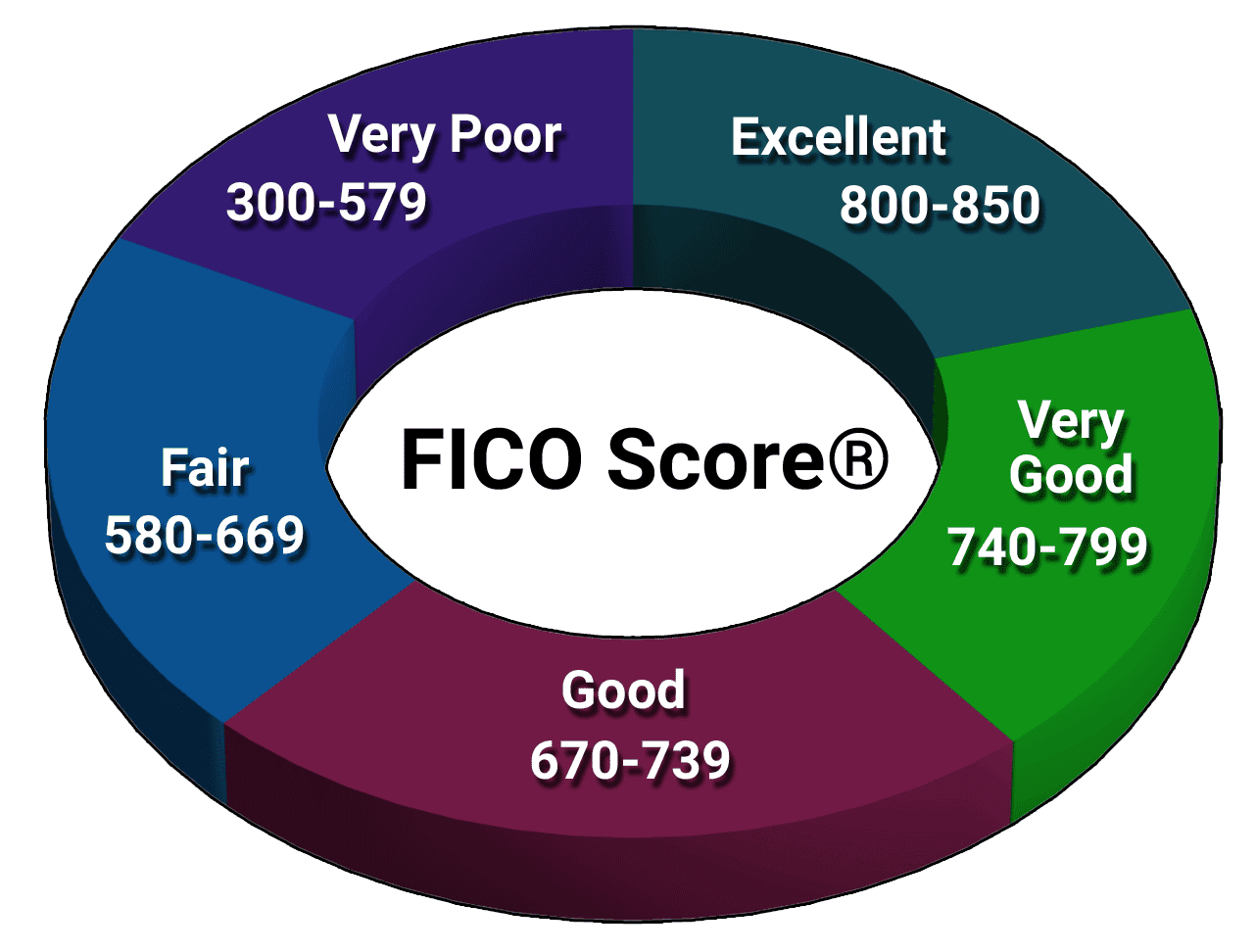

Generally, people with good credit scores have higher access to credit and find it easier to borrow large sums of cash. Instead, you can use the credit score ranges to gauge your ability to borrow money. Similarly, you could have very poor credit and find a lender willing to extend credit to you. You could have a perfect credit score and still find a lender that denies your application. It’s important to note that while the credit score ranges are useful for getting a quick idea of the quality of your credit, they don’t offer any concrete perks or guarantees. Having lower debt balances compared to your credit limits also helps to increase your credit score. Generally, the more on-time payments and the fewer late payments you’ve made, the better your score will be. Some of the most important factors in determining your credit scores are your payment history and how much debt you currently have. Even within the FICO Scoring model there are multiple ways of calculating credit scores.įor example, you might get one score using the FICO Score 8 model and a different one using the FICO Mortgage Score model.Īll credit scoring models look at similar information about how you’ve managed your bills in the past. One of the most popular is the FICO Score, developed by Fair Isaac Corporation.

There are a wide variety of credit scoring models. Like the letter grading system that people are familiar with from school, there are different credit score ranges that most credit bureaus and lenders agree on. Higher numbers indicate better credit, just like a higher score on an exam indicates a better grade. Credit scores are numerical scores that range from 300 to 850.

0 kommentar(er)

0 kommentar(er)